Playback speed:

The SaaS market has grown with tremendous speed as a result of its impressive innovation, coming up with quick and smart solutions to a host of organizational problems.

Especially over recent years, the SaaS segment has significantly shaped the technological world we live in.

Its incredible expansion is largely due to a series of industry-specific characteristics, namely its contribution to productivity optimization and highly flexible payment options.

With SaaS businesses offering services that fulfill all sorts of needs and that are helpful across many operational fields, the SaaS sector is one of the most dynamic industries today.

Having a significant impact on the worldwide economy, current trends in the SaaS industry reveal huge opportunities that business people should be aware of.

Therefore, to discover where the SaaS market is headed in the near future, I’ve put together a couple of SaaS statistics to offer an in-depth view of the market.

Let’s dive in!

General SaaS Industry Statistics

As a result of the COVID-19 pandemic, many businesses were forced to completely change their methods of operation, adapting to remote work out of necessity.

Furthermore, in such uncertain times, adaptability, as well as cost optimization, was crucial for keeping businesses afloat. This being possible – to a greater or lesser extent – thanks to Saas businesses in particular.

While the SaaS sector was already one of the most promising, the new socio-economic scenario paved the way for even greater developments.

Moving forward, we’ll uncover the extent of this expansion by looking at a few SaaS industry statistics, to reveal what the data has to say about this sector’s growth over the last couple of years.

- The SaaS market has tripled its size in the last five years.

- As of 2022, the SaaS market has a value of $186.6 billion.

- The SaaS industry currently has an annual growth rate of 18%.

- The world’s leading countries with the most SaaS companies are the US, UK, Canada and Germany.

- SaaS growth can generate between $5 million to $100 million in annual recurring revenue.

- Financial services, analytics and information technology and services are the major 3 SaaS industries.

- The combined market value of the top ten SaaS companies exceeds $1 trillion.

- The retail and e-commerce sector of the global SaaS market should reach $138.9 billion by 2027.

- The US SaaS industry is set to more than double in growth by 2025, as well as in all major European markets.

- The relevance of cloud-based business has grown to the point that 84% of organizations use a multi-cloud strategy to manage their work more effectively.

- Among South American countries, Brazil places the greatest emphasis on SaaS as a startup model.

SaaS Companies Statistics

SaaS growth metrics and benchmark rates can provide useful insight for software companies into how widely SaaS applications are used, as well as the impact of such expansion on the modern workplace.

That is why to help future entrepreneurs thinking about investing in the SaaS industry, I’ve compiled the latest SaaS statistics showcasing the most promising markets, as well as the needs and demands this industry faces.

- The US has approximately 8x more SaaS companies than any other country.

- Companies spend an average of 25% of their budget on a public cloud and different SaaS solutions.

- Over 99% of companies on the market use at least one SaaS tool to run their business.

- 38% of companies switch to SaaS and a public cloud to keep their data safe from possible disasters that may damage local servers.

- 37% of companies adopt cloud-based systems for their flexibility.

- 38% of companies say that 100% of their operational processes run on SaaS platforms.

- 93% of CIOs (chief information officers) state that SaaS adoption can help businesses grow and achieve their goals.

- 48% of businesses have an average of one-year SaaS contracts, while 11% have contracts for three years or more.

- 48% of businesses want to improve their management of SaaS products in the next year. 54% want to optimize and find savings in their software spending. (Flexera)

- 57% of European and US companies increased their SaaS spending last year. (Paddle)

SaaS Business Statistics

The SaaS industry is experiencing unprecedented growth due to the increased use of automation over traditional methods.

Many firms are shifting to a totally SaaS-based model, resulting in increased SaaS demand and a greater rate of return.

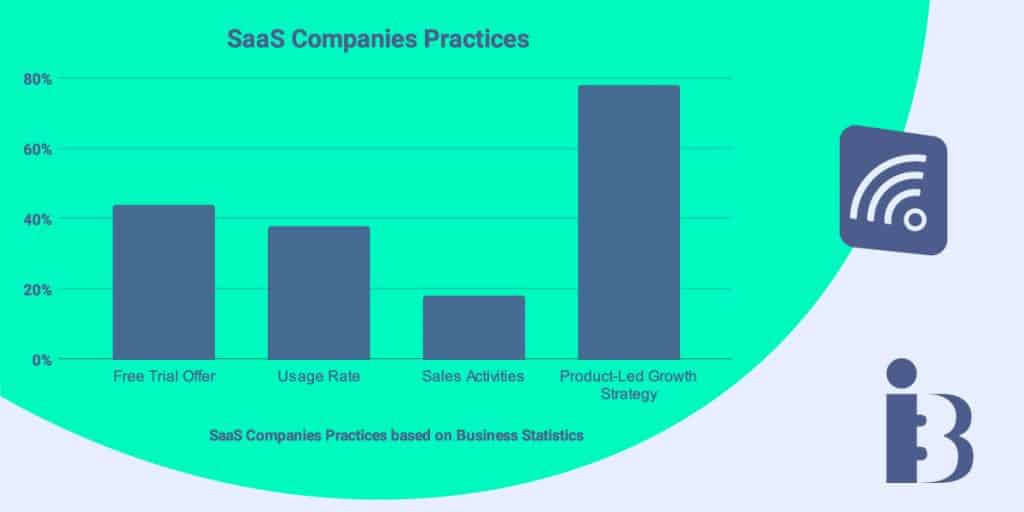

To define what sets the SaaS market apart from other industries and understand the particularities that led to its success nowadays, we’ll analyze a few SaaS business statistics indicating common practices adopted by Saas companies.

- 44% of SaaS companies offer a free trial.

- 38% of organizations that provide SaaS solutions do not generate income through monthly subscriptions. Instead, they switch users based on their usage.

- SaaS businesses dedicate about 18% of total revenue to sales activities.

- The web and video conferencing SaaS market will reach $7 billion by 2026.

- 78% of SaaS companies follow product-led growth strategies by offering potential customers free plans or trial periods.

SaaS Adoption Statistics

The world of SaaS companies is dominated by dynamism.

Thanks to their cloud storage, SaaS apps allow rapid adjustments to be made and adapt to their customers’ needs swiftly.

Not requiring any sort of installation (in most cases) and coming up with helpful updates fairly quickly, SaaS tools allow employees to simplify their work processes. This ultimately leads to increased productivity and more room for growth overall – which is the primary reason an increasing number of businesses are turning to SaaS solutions.

- Companies use an average of 34 SaaS applications.

- In terms of adoption, North America has the most mature SaaS market.

- 70% of CIOs claim that agility and scalability are two of the top motivators for using SaaS applications.

- 49% of B2B SaaS companies have seen no difference in their churn rate because of the pandemic. Only 35% of them feel it is slightly higher than normal.

- 89% of SaaS users care about personalization and are more drawn to products that allow it.

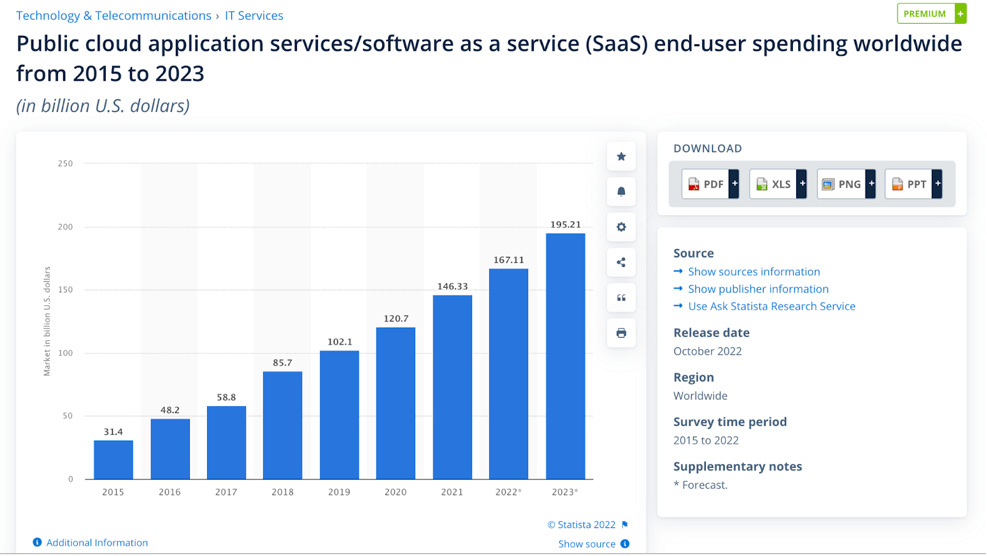

Source: Statista

SaaS Usage Statistics

SaaS businesses nowadays operate in all the major sectors, and are particularly active in the marketing industry.

While some tools are indispensable for a company, others are simply nice to have and located toward the end of the priority list.

To gain a better understanding of the SaaS sector’s growth and get a handle on its triggers and future direction, it’s paramount to look at usage patterns, which the below-stated SaaS statistics reveal.

- Every tenth SaaS product that users pay for remains inactive for the first 90 days.

- 77% of managers want to get a solution that helps measure the effectiveness of their subscription-based cloud services.

- Overall spend per company on SaaS products is up 50%, and the number of unique apps in usage per company is up about 30% year over year.

- With over 35% market share in three major African nations, Azure is the leading SaaS usage company.

SaaS Industry Trends and Projections

In the tech world, the hype about AI started a couple of years ago and continues to intensify by the year, especially now, with the launch of an artificial intelligence technology that enables natural language processing – GPT3. Which is gaining popularity.

When talking about SaaS trends and predictions, AI integrations simply cannot be left out, as this seems to be the next big thing due to skyrocket the SaaS market. The demand for such integrations is born out of the need to increase the user’s ability to customize SaaS applications.

Following this, another trend that could make or break SaaS businesses in the near future is their competence in developing highly-personalizable apps. Lately, this has been a request that has started to gain more and more importance for SaaS clients, and not only.

Last but not least, it’s equally important to note that one of the most significant future trends in SaaS will be mobile-first development. This probably will eventually imply that new apps are designed first for smartphone accessibility and then converted for PC. Which is opposite to the way things have been running so far.

This new approach is crucial for businesses that want to survive in the long run. Especially since roughly three-quarters of internet users (3.7 billion people) are predicted to access the web only through their smartphones by 2025.

Without further ado, let’s see what data has to say about the latest SaaS projections.

- By 2024, SaaS revenue is estimated to reach $369.4 billion.

- By 2025, the SaaS sector in the United States is anticipated to be worth $225 billion, being already the largest SaaS market in the world. (Gartner)

- SaaS industry value is expected to more than double in major European markets. (Statista)

- Up to 70% of a company’s overall software usage is made up of SaaS. By 2025, it is anticipated that 85% of software used by businesses will be SaaS.

- The value of the SaaS market is expected to reach $700 billion by 2030.

SaaS Market Statistics

Before founding a SaaS company, people usually analyze and take inspiration from the best players in the industry. After all, they all got to the top by implementing successful strategies.

Asking fellow SaaS entrepreneurs about their companies’ tactics can prove effective for developing more productive business plans. Checking out the latest SaaS market statistics, like the ones below, is equally beneficial.

- Germany is expected to experience the largest increase in SaaS market growth from major markets by 2025, from €6.85 billion to €16.3 billion. (Statista)

- It is estimated that Japan’s SaaS market value will exceed ¥1.5 billion in 2023. (Cisco)

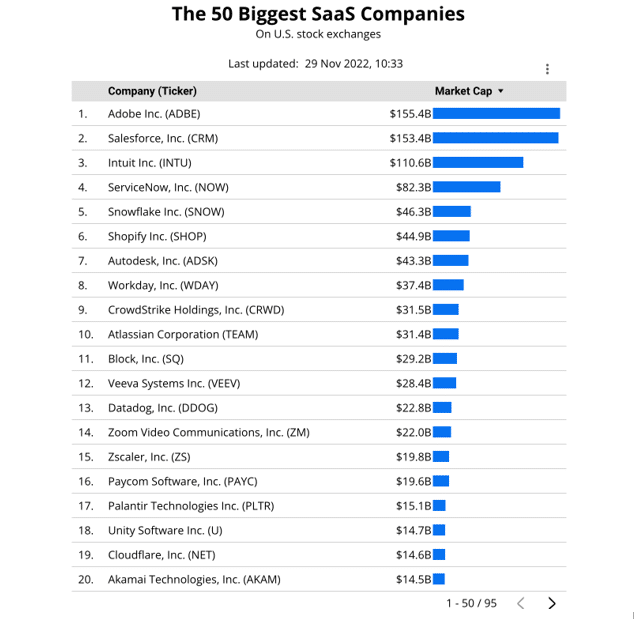

- As of June 2022, Adobe Inc. is the largest SaaS company in terms of market cap, followed by Salesforce and Intuit. (Mike Sonders).

- Microsoft is the number one SaaS provider, with over 15% market share.

- The market revenue generated by Zoom has increased 5x during the last five years.

- Cisco experienced only 1% growth in the SaaS market last year.

- Visma is a leading SaaS company in the CRM market.

- The web and video conferencing SaaS market is estimated to reach $7 billion by 2026.

Source: Mike Sonders

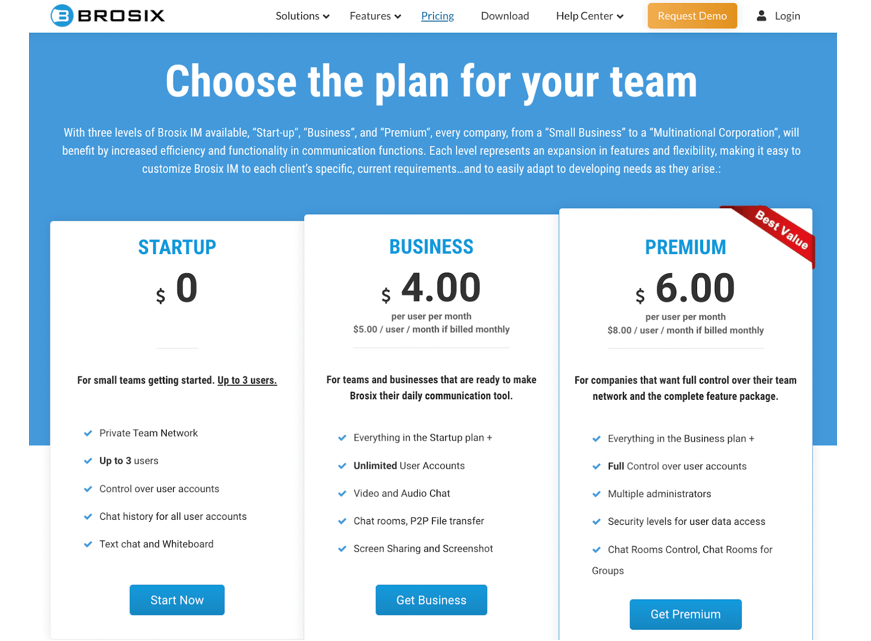

SaaS Pricing Statistics

Many of today’s SaaS products are built on a self-service business model, allowing potential customers to make online purchases without ever speaking to the company directly.

While this is a highly cost-effective method of selling subscriptions, enabling SaaS companies to generate predictable revenue, it also turns them into a commodity, which weakens customer loyalty.

Undoubtedly, tiered-subscription pricing has removed a series of buying obstacles by letting customers select packages that suit their needs.

On the other hand, it’s not always the best option as it requires users to commit to an expense over a set period of time, regardless of how much value they derive from the product.

This is why – in order to improve price-value alignment, the SaaS sector is transitioning to a more tailored revenue model, usage-based pricing.

As highlighted by the latest SaaS pricing statistics, the financial future of SaaS is built around pricing structures in which customers pay a fixed amount based on the value they obtain from the product.

To get the best of both worlds, SaaS startups and larger businesses are now adapting to a hybrid pricing module, adjusting their subscription plans and considering consumption.

This means customers can still choose a subscription tier with this setup, but they are not required to level up when they exceed their predetermined restrictions. They can instead pay overages for the extra resources used.

The blended revenue model allows for flexible usage even within subscription tiers, which contributes to superior customer experience. It enables the monetization of infrequent and seasonal consumers while assisting SaaS companies in generating predictable revenue.

- About 40% of SaaS companies take a value-based approach to set pricing.

- 30% of SaaS businesses charge based on usage.

- A “per user” pricing method is used by 46% of SaaS organizations.

- 50% of SaaS companies adjust their prices depending on the needs and desires of potential customers.

- Prospects often receive a presentation or free trial from 44% of organizations that offer SaaS solutions.

- 30% of SaaS companies provide customers the option to upgrade the functionality of the services they’ve contracted.

- 98% of SaaS businesses experience positive results from dynamic pricing.

- 40% of organizations want to use new pricing models once all businesses recover from the crisis.

- 30% of SaaS companies offer price cuts for their customers.

- 43% of SaaS companies revisit their pricing packages more than once a year.

- According to data, 44% of B2B SaaS companies prefer sales-negotiated pricing, followed by fixed pricing (34%), with variable pricing being the least appreciated (24%).

SaaS Sales and Marketing Statistics

As data has indicated, for businesses in the SaaS industry, content marketing is the top-performing advertising medium, having the highest ROI.

However, with marketing playing such a significant role in a company’s success and growth, it’s only natural that a wealth of resources and channels are leveraged.

But which, and to what extent?

Listed below, a couple of SaaS marketing statistics offer some insights:

- SaaS companies spend the most on marketing and sales, up to over 50% of their revenue.

- In the first five years, an average SaaS business invests 80% of its revenue in marketing and customer acquisition.

- Freemium SaaS solutions convert over 20% more customers than free trials without sales.

- More than 30% of SaaS businesses use informative blog content to bring in new customers.

- For SaaS firms, high-quality content marketing can produce an ROI of 448% or higher.

- About 65% of SaaS companies use webinars, 62% include case studies and 18% have podcasts in their marketing plans. (Business2Community)

- Organic search accounts for 85% of blog traffic for SaaS companies.

- 94% of B2B SaaS companies use LinkedIn to distribute content.

- Educational blog posts generate 14% more traffic to company websites than pure news or PR blogs.

Final thoughts

Undoubtedly, the SaaS industry’s immense development has been heavily influenced by the COVID-19 pandemic and the new reality of working from home.

During these times, more entrepreneurs – challenged by the new work scenario and struggles – tried to come up with creative ways of facilitating everyday tasks – and this is how many new organizations came to life.

With such a volatile economy, one can never be truly certain of what the future may bring.

However, as emphasized by the SaaS stats above, this industry is expected to grow even more in the future, making it one of the best sectors to invest in.

Among the key takeaways, the SaaS stats presented have highlighted the importance of content marketing and SEO for a productive business, as the most cost-effective marketing channel choice.

One of the best examples of this is the world-known SaaS business, HubSpot, which has grown its B2B SaaS company to over $866 million in revenue, mainly using SEO as the foundation.